When it comes time to consider downsizing your home, there are a mix of emotions and stressers you may have never encountered before. For seniors, it’s a situation that sometimes comes about out of necessity and sometimes simply as a way of improving the quality of retirement years.

As the number of Baby Boomers entering retirement continues to climb in the US, the reasons to start downsizing are more apparent than ever:

- Economic necessity. It’s common for many older adults to be faced with unexpected medical expenses, growing homeowners insurance rates, and rising utility costs. Selling the house and moving into a more affordable space is often the solution.

- Health concerns. Many seniors downsize to a home where at-home care is more convenient and there are fewer everyday obstacles to maintaining good health.

- Convenience. If you’re tired of doing all the housework that comes with a larger home, you’re not alone. A lot of retirees opt for smaller homes where upkeep is less of a responsibility.

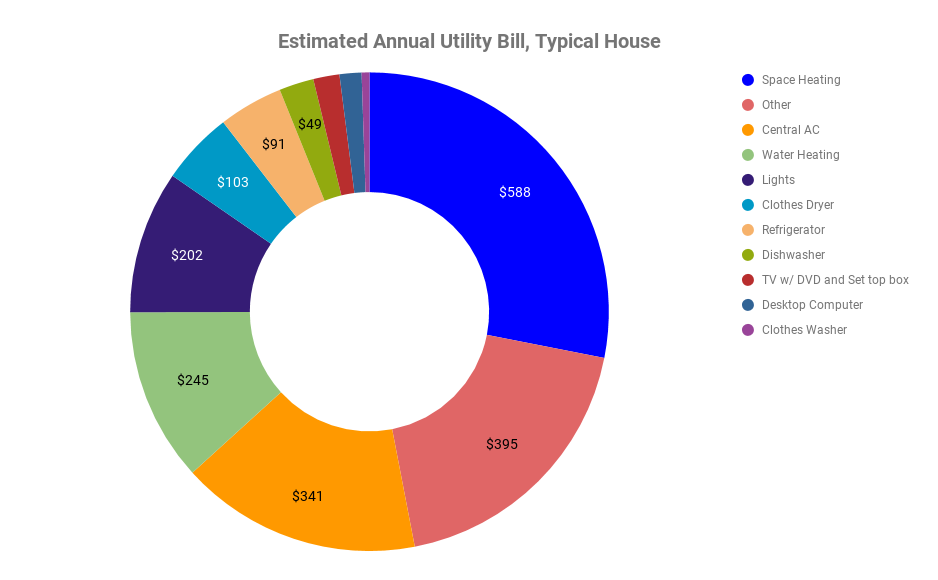

In terms of the cost benefits, retired seniors stand to save significantly when moving to a smaller space. Consider that for the typical single-family home, heating and cooling accounts for 42% of the energy bill, according to the U.S. Department of Energy. When the square footage of your home shrinks, so does that energy bill.

Source: 2016 Energy Star data

Moving to a smaller home could also help you save on:

- Mortgage payments

- Property taxes

- Maintenance (lawn, pest control, snow removal)

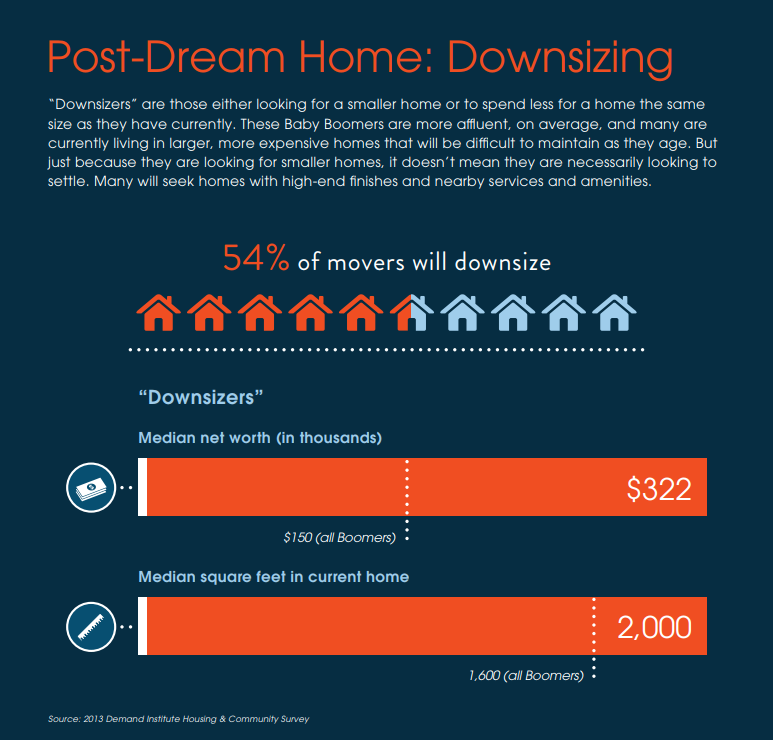

If you’re preparing for retirement or have already retired and you’re now considering downsizing, know that you’re in good company. A poll by the Demand Institute concludes that 37% of Baby Boomers plan to move later in life. Of those planning to move again after retirement, 47% said they’d like to downsize. Since there are roughly 75 million Baby Boomers in the US, we can expect roughly 10 million retirees to downsize in the coming decades.

Read on for helpful tips and guidance as you think about what matters most for your retirement, including the home you envision yourself in.

Budgeting for a downsize

Choosing to downsize to a smaller home in retirement isn’t always motivated by economics, but it is always affected by it. Even for retirees belonging to a high tax bracket, downsizing is a consideration for practical reasons:

Source: 2013 Demand Institute

No matter why you’re considering a new home, putting together a well-thought out budget you can stick to is a wise first step. We can break your budgeting plan down into several key points you should account for:

What are you paying now? What will you pay in a downsized home?

Make a list of all the expenses associated with your current home. This should include: mortgage payments, utility bills, maintenance costs, HOA fees, and everything else you pay on a monthly basis. You’ll be able to calculate these same expenses for your new, smaller home (or at least come up with a realistic estimate).

To figure out the monthly mortgage payment for your new home, simply note its list price and plug it into Bankrate’s mortgage calculator. You’ll be able to change the mortgage term, down payment amount, and mortgage rate—giving you a very clear idea of what your mortgage payment will be at the new home you’re considering.

After coming up with your “new” mortgage payment, you should also be able to determine a rough estimate for utility costs. If you’re thinking about moving out of state, take a look at the U.S. Energy Information Administration’s recent numbers for average monthly bills for single family homes by state. If you’re downsizing but also moving to a state where energy costs are on average higher, the savings may not be as great as you’d hoped. However, differences in energy costs can also work in your favor.

Let’s say you currently live in Connecticut, where energy bills are among the highest in the nation at around $142 per month. If you move to Florida, where monthly energy bills are $123 on average, you’ll save a couple hundred dollars a year on energy alone.

Find out if your target home has an HOA, and also take into account things like lawn services. Add these expenses up and the overall cost benefits of downsizing will become clear.

What’s your current income?

Preparing for a move is a great reason to reassess your financial big picture. Everyone’s financial outlook is unique, so taking the time to piece together all sources of income you have, as well as savings accounts and more, will help you develop a game plan.

Critical questions to ask yourself:

- If you’re not yet retired, how realistic is your goal retirement date?

- What alternative sources of income do you have?

- Will you be applying for Social Security? If so, when? (Note: the age at which you are eligible for Social Security is between 66-67, depending on the year you were born.)

Answer these questions to determine what your monthly income is, how much you have in savings, and what a comfortable mortgage payment will be for your next home.

What will it cost to sell your home and buy another?

Most retirees have been through the home-selling process before, but many haven’t in years, maybe decades. Take into account the extra fees and expenses that come into play when selling a home:

- Realtor’s commission. The fee you’ll have to pay your realtor is typically 5-6% of the sale cost.

- Closing costs. Depending on the real estate market you live in, you may be asked to take care of closing costs, which include property taxes, attorney fees, and other miscellaneous fees.

- Inspections and home repairs. Buyers want thorough home inspections before signing on the dotted line; if any structural, electrical, or plumbing issues come up, you may have to cover those expenses.

- Mortgage payoff. If your loan has a penalty for paying off the mortgage early, you’ll have an extra expense you may not have already accounted for. The sum you make from selling the home will mostly go into paying off the current mortgage.

The responsibility of some of these costs can shift from homeowner to homebuyer, so knowing exactly where you stand with these fees is a critical component to your downsizing budget.

Although there are many reasons for downsizing, budgeting carefully to make your new home less expensive than your current home is a huge benefit. It’s easy to lose track of all the small expenses that come with a move, but with a little diligence, you can save big in the long run.

What’s the plan?

Once your budget is in order, you’ll have to get the wheels turning on a strategy. There are a lot of moving parts in play, so breaking down your plan into simpler terms is a good place to start:

Selling your home and assets

Will you use a realtor or opt to sell the home yourself?

Keep in mind that selling the home yourself will entail a whole new list of responsibilities and tasks that may delay your moving process beyond your original timeline.

Will you be selling a car?

If you don’t do much driving, don’t want the responsibility, do want the money, or have a health concern keeping you from driving, selling a car is a wise decision. Many retired couples who have two cars and will sell at least one when downsizing as a way to collect some cash and free up space.

What other assets do you have?

A bittersweet, yet rewarding, part of downsizing is getting rid of stuff you no longer need. Whether that means valuables you no longer need or junk taking up space in your garage, let it go! You’ll be surprised at how freeing it is to clear out the basement and get paid for the stuff you haven’t used in ages.

Finding a place to live

Would you prefer to stay in the same area or are you excited about moving to a new place? If you’re moving somewhere new, take into consideration all the amenities you’ll need now and later on. Check for proximity to hospitals, grocery stores, and other essentials. Downsizing should make life easier—if you have to travel 45 mins to weekly doctor appointments, think about how that will affect your quality of life.

Considering all housing options

Single-family home — With a smaller single-family home, you can expect a similar lifestyle to the one you live now, but with fewer responsibilities and less clutter.

Condo/Townhome — Condos and townhomes are excellent options for retired seniors who value their freedom and self-sufficiency and also want to get off the hook for property maintenance. Don’t forget to take a look at HOA fees.

Assisted living community — Assisted living communities provide housing, meal prep, and health-related services for seniors. Many include luxurious amenities and a more thorough level personal care. Assisted living is an option for seniors with health concerns.

Move in with your adult children — If you’ll be living with family, any financial burdens you had in your own home will be eased. Being close to children and grandchildren is another benefit of moving in with family. Not enough room at their home? Do some research on “Granny Pods,” the latest trend in senior living. Granny Pods are essentially tiny homes that can be built in the backyard of your adult child’s home. Seniors who want to live with their kids can buy a Granny Pod and be close to home without feeling like a burden.

Finding a new mortgage

Downsizing to a new home in your retirement years puts you in a unique position when it comes to finding a mortgage.

After selling your old home and extra assets, you’ll be in a position to apply for a decent short-term mortgage with manageable monthly payments. Be sure to check mortgage rates often and track trends in your new area to secure the best loan you can. You’ll most likely be interested in one of the following:

- 10-year mortgage. The shortest-term mortgage and usually the one with the lowest rates, ten-year mortgages are great options for those who want to quickly accrue equity in their home and pay less interest than they would with a longer mortgage. Monthly payments will be higher than with other term-lengths, but if it is still lower than the payment you have at your current home, it’s worth it.

- 15-year mortgage. Fifteen-year terms will also carry lower mortgage rates and APRs than longer term mortgages, though obviously not as low as with a ten-year term. If you want to get the house paid off as quickly as possible but you aren’t comfortable with the monthly payment associated with a ten-year mortgage, consider a fifteen-year term instead. You’ll have a little more leeway in monthly spending while still paying off the home relatively quickly.

- Reverse mortgage. If you want to tap into your current home’s equity before moving out, consider a reverse mortgage. Your bank will submit payments to you based on a percentage of the equity you have in your home and you won’t need to immediately pay it back. Loans don’t need to be paid back until the homeowner sells the home or dies, making reverse mortgages an intriguing retirement tool for seniors who are thinking about downsizing to a new home.

No matter the reason you have for considering downsizing, you are wise to contemplate its advantages. Not only do you have the opportunity to start anew, perhaps in closer proximity to family, but you can drastically improve your quality of life in retirement. By downsizing to a smaller home, you are freed from the upkeep responsibilities of owning a large home. You’ll potentially save big on standard costs associated with homeownership and most importantly of all, you can finally take time to relax.

Try Bob's free retirement calculator - The retirement calculator was featured on 'The Saturday Early Show' by CBS' top financial analyst just click the blue button below. Take control so you can reach your retirement goals and connect to a trusted financial advisor near you so you can Retire Fast!

The information in this article is not to be taken as financial or investing advice. Always seek the services of a Financial Advisor, Accountant or Financial Planner. Retire Fast. is a Marketing Agency in Metro Detroit, MI.

Retire Fast. is not Licensed as a Broker-Dealer or Investment Advisor. Neither Consultant nor any employee of Consultant is a licensed broker-dealer and Consultant is not being retained to offer, sell or place any securities of the Company. No fees paid pursuant to any Agreement relate to commissions for the placement or sale of securities. Neither Consultant nor any employee of Consultant is a licensed investment adviser and Consultant is not being retained to make any valuations of the securities of the Company or of any entity the Company may consider acquiring in the future. The Company acknowledges that neither the Consultant nor any employee of Consultant has been retained to provide investment advisory services to the Company.